Capital Idea: NEXA Capital Gives UAM Lift and Keeps It Grounded

Step 1: Get a degree in aeronautics from MIT. Step 2: Go into finance.

Huh?

Let’s just say Michael Dyment took an unorthodox flight path out of college but actually ended up merging his love for aviation with his affinity for aviation innovation. The result is NEXA Capital, which Dyment founded in 2007, a boutique investment firm focused on aerospace opportunities.

Today, as NEXA’s managing partner, Dyment sees opportunity in UAM, or at least key sectors within what will soon be a US$1 trillion market (some ultimately project it will be a US$3 trillion market).

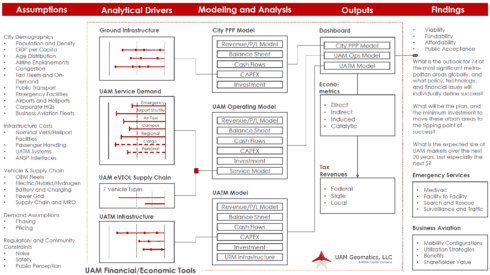

With investments ranging from US$2MM to US$150MM (and perhaps ultimately as high as US$500MM), NEXA focuses on four key segments of the greater UAM market opportunity: the supply chain, including vehicle manufacturers and infrastructure suppliers (both ground based, such as construction companies, and satellite operators); vehicle structural composite manufacturers; UTM/ATM (current air traffic management is not equipped to handle what UAM will need); and vehicle operators (the “airlines,” if you will, of UAM).

Risk and Reward

Each of these areas is complex and include subsegments, such as artificial intelligence, sense-and-avoid sensors, electric motors, and radio frequency ID (RFID). Within these areas, Dyment’s team is looking for opportunities that will materialize within the next three to five years. Vehicles that could, for example, be certified by 2021, will be in high demand as the first two to three manufacturers will be able to capitalize (pun intended!) on the limited supply.

With returns on investment ranging from 4% to 6% per annum for comparatively low-risk investments (the kind favored by, for example, pension funds) to 15% to 25% on what are sometimes referred to as “moonshots” (high-risk/high reward), Dyment and his colleagues have studied the landscape (and the skies above them). They have identified what the challenges are, where the opportunities lie, and which areas in the sector—where US$3 billion has already been invested in vehicle manufacturing alone—are the best bets for investors.

In the way that the U.S. interstate highway system constructed during the 1950s and ’60s facilitated tremendous growth in interstate travel for commerce and pleasure, building infrastructure to support UAM is likely to jumpstart the commercialization of eVTOLs and other low-altitude vehicles.

Markets where coalitions have been formed that include governments, universities, and the private sector (such as vehicle manufacturers, operators, and tech companies), are well-positioned for private capital investment says Dyment.

A market like Syracuse-Albany, New York, for example, where the two cities enjoy substantial intercity traffic between the university and state capitol government agencies, is theoretically ideal for the type of regional transportation UAM can enhance. There, infrastructure (such as vertiports) and ATM networks might be good places to place your bets. Also, places along the supply chain, such as AI and automation, where flight risks can be mitigated (roughly 80% of accidents are human error), look more viable than other segments of the US$1 trillion market.

Risk and Riskier Risks

Some of the more challenging risks facing investors and industry players alike are things like certification of their “new-fangled” designs by the FAA in the US and EASA in the EU. Overseas markets for the sale and operation of certain eVTOLs may be limited due to the U.S. Department of Defense tightening up restrictions on which technologies can be sold, and to whom.

Other challenges start at the very beginning—public perception. Local governments embracing UAM, such as Seattle-Vancouver, Toronto, Los Angeles, Miami, and Dallas-Ft.Worth in the U.S. and London and Paris in the E.U., will help improve public acceptance as UAM’s benefits, including reduced road congestion and increased employment and, therefore, tax revenues, are explained to leery constituencies.

UAM, or as NASA is now calling it, AAM (Advanced Air Mobility) is coming. And, it’s coming sooner than the public at large realizes. But some folks see the future and for them, people like Michael Dyment, and firms, such as NEXA Capital, the future is NOW.

Want to continue to stay up-to-date about the latest developments in the eVTOL industry? Subscribe to AeroCar Journal now. It’s FREE (for a limited time)!

Join us on Twitter for the latest news, analysis, and insight in the eVTOL industry. AeroCarJ